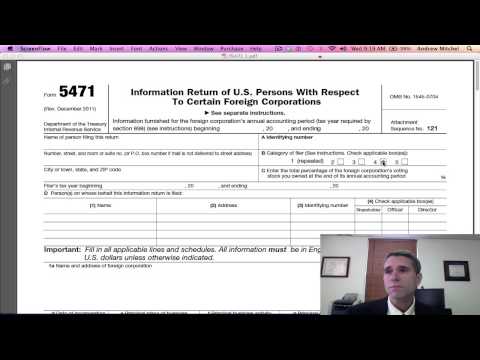

Hi, I'm Andrew Mitchell. Today, I'm going to talk a little bit about page one of Form 5471. It is an informational tax return required for certain foreign corporations by US persons who own certain interests in foreign corporations. Failing to file this form can result in a penalty of $10,000 or more. - Starting with the top, the foreign corporation's annual accounting period under Section 898 is generally required to be the same as the US majority owners. For individuals, this is usually the calendar year. However, there is an exception in the proposed regulations under Section 898. If you have had no dividends or subpart F income to date, you are not required to file Form 5471 using the same year-end as the US shareholders. - The US person filing the return is usually the US owner of the controlled foreign company. You would need to provide the address and identifying number of the US owner. For individuals, the identifying number would be a social security number or an ITIN. For corporations, it would be an EIN. - The category of filers can be confusing. Category 1 filer has been repealed. Category 2 filer generally applies to US persons who are officers or directors of foreign corporations. They only need to file in years when they acquire a 10% or more interest in the foreign corporation or dispose of their full interest. This is also known as category 3 filers. - Category 3 filers are individuals who have acquired a 10% or more interest in a foreign corporation. If you acquire additional 10% or more interests, you will need to file again. However, category 3 filers are not required to file annually. They only need to file in the year of the event. - Category 4 filer applies if you control a foreign...

Award-winning PDF software

5471 (Schedule J) Form: What You Should Know

Jason Knot, I don't understand the situation. Would the Social Security Administration be authorized to collect federal tax withheld from your benefits? Or would you need a signed Form W-4V? Also, is it even legal for the Social Security Administration to take the tax money? If the Social Security Administration can't collect it, it wouldn't be considered legal because these types of payments are federal government money, and they are under the control of the Social Security Administration. If the Social Security Administration wants to collect the tax, it means they get their tax money first. It wouldn't be considered legal for people who get unemployment benefits to ask the Social Security Administration to take their tax money. The money is theirs. If Social Security collects the tax, it would be considered a violation of the tax laws. I don't understand the situation. Would the Social Security Administration be authorized to collect federal tax withheld from your benefits? Or would you need a signed Form W-4V? Also, is it even legal for the Social Security Administration to take the tax money? If the Social Security Administration can't collect it, it wouldn't be considered legal because these types of payments are federal government money, and they are under the control of the Social Security Administration. If the Social Security Administration wants to collect the tax, it means they get their tax money first. It wouldn't be considered legal for people who get unemployment benefits to ask the Social Security Administration to take their tax money. The money is theirs. If Social Security collects the tax, it would be considered a violation of the tax laws. Aug 26, 2025 — How to Get Your Unemployment and Social Security Check in the Same Day. Aug 26, 2025 — Unemployment and Social Security Taxes July 2025 (Updated). PDF version, Form 2949-A — Unemployment Compensation Tax and Benefit, Form 2949-A — Social Security Tax Credit Summary. Aug 26, 2025 Jul 24, 2025 — Taxes for the Beginning of the 2025 Tax Year (Updated) PDF version, Unemployment Compensation Tax and Benefit, Social Security Tax Credit Summary. Aug 22, 2025 Jul 18, 2025 — Taxes for the Beginning of the 2025 Tax Year (Updated) PDF version, Unemployment Compensation Tax and Benefit, Social Security Tax Credit Summary.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5471 (Schedule J), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5471 (Schedule J) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5471 (Schedule J) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5471 (Schedule J) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 5471 (Schedule J)