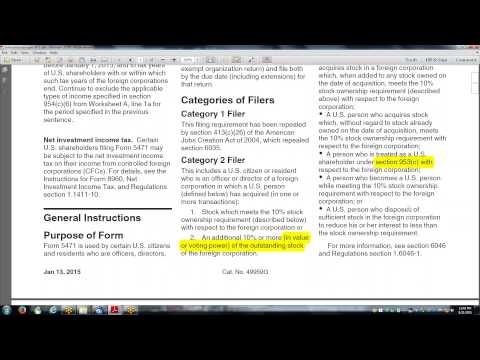

Our international clients, as you know, have foreign partnerships and foreign disregarded single-owner entities. They sell a foreign information return, which is just that - information. There are no adverse tax results that will take place because these pass-through entities are a good place for tax elections and tax planning. We will discuss this further later on. However, when it comes to Form 5471, it is important to note that it is involving a C-corporation. Every foreign corporation is considered a C-corporation, and any mistakes can result in unexpected taxation. The trick with Form 5471 is to work with the client and a pro forma 5471 mid-year, as there are some year-end tests and quarterly tests regarding investments in U.S. property, specifically Section 956. We will briefly touch on this later. Another trick is to ensure that you follow the correct parts of the tax return. The IRS breaks this up by category and there can be some confusion. The categories to follow are categorized by whether or not a U.S. person has a 10% or more ownership in the stock. This includes both voting and non-voting stock. It is important to note that the tax book income only goes towards the voting power, but controlled foreign corporations have been looking at non-voting stock as well. This was a loophole that has since been closed, but it can still cause confusion. Category two refers to citizens or residents who are officers or directors in a company in which a U.S. person owns 10% or more of the stock. The law looks at both voting and non-voting stock. The test for this category is for people who have acquired or increased their stock ownership by 10% or more. Category three refers to U.S. persons who acquire stock in a foreign corporation that they already...

Award-winning PDF software

5471 Schedule J 2025 Form: What You Should Know

The revised filing requirement also applies to Form 1040 (see note on Form 1040), but not Form 1120 (see note on Form 1120) and other Form 1041-based form. Taxpayers are not required to file Schedule J from a foreign base company. Form 5471 Schedule J Instructions for Form 5471 (Use with the December 2025 revision of Form 5471 and separate Schedules E, I-1, J, and P, the December 2025 revision of separate Schedules H, I-1, J. and P). The revised filing requirement applies to Form 1040 (see note on Form 1040). See FAQs regarding filing a revised Form 5471. See FAQs regarding filing a revised 5471 Schedule J (use with the December 2025 revision of Form 5471 and separate Schedules E, I-1, J. and P.) The revised filing requirement also applies to Form 1041 (see note on Form 1040). See FAQs regarding filing a revised Form 5471. See FAQs regarding filing a revised 2016 Q/A #29: Is a tax withholding extension required on Forms 5471, Form 5471A, Form 5471B, Form 5471C, Form 5471D, Form 5471E, or Form 5471F? May 20, 2025 — Schedule J of Form 5471 of a foreign qualified intermediary (TIP) is filed with the IRS on or before December 24; or Form 5471A of a TIP is filed with the IRS on or before the latter of December 31 and the day the TIP is recognized by the IRS. Filing Schedule J of Form 5471 of a TIP — IRS The U.S. person's Form 5471 will require the year of establishment to have been for at least five full calendar years (5 yrs.). The U.S. person's Form 5471 will also require that foreign base company income (excluding certain dividends) be derived from U.S. sources. Form 5471A, Balance Sheet with Foreign Income (Form 5471A) — IRS The U.S. person's Form 5471 will require the year of establishment to have been for at least six full calendar years (6 yrs.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 5471 (Schedule J), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 5471 (Schedule J) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 5471 (Schedule J) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 5471 (Schedule J) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 5471 Schedule J 2025