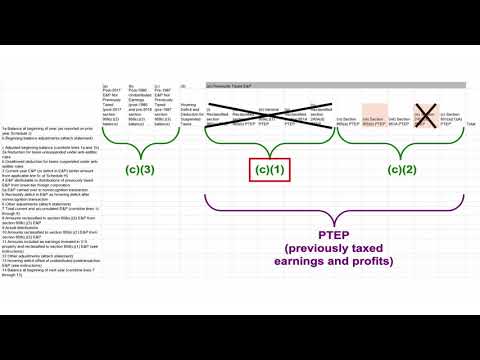

In this video, we will discuss Schedule J of Form 5471. Schedule J tracks the earnings and profits of controlled foreign corporations (CFCs). Page 1 has 14 rows and 6 columns, and page 2 has the same 14 rows but 9 columns. To make it easier to understand, I have recreated Schedule J with all the columns and rows on one page. Let's first categorize the columns. Columns A through C show Section 959 C3 earnings and profits. Columns E1 through E5 show Section 959 C1 earnings and profits, and columns E6 through E10 show Section 959 C2 earnings and profits. We will refer to these as C1, C2, and C3 earnings and profits. C3 earnings and profits have not yet been taxed to the U.S shareholder. C1 and C2 earnings and profits have previously been taxed to the U.S shareholder, so they are referred to as previously taxed earnings and profits (PTEP). C1 earnings and profits only exist if the CFC has investments in U.S property, usually a loan from the CFC to the U.S shareholder or a U.S person related to the shareholder. For the sake of this video, let's assume the CFC has no investments in U.S property, so we can ignore columns E1 through E5. Column E9 tracks PTEP created under Section 245 cap A(d). This type of PTEP is created when a CFC owned by a domestic corporation receives certain hybrid dividends from another CFC. Again, assuming no hybrid dividends were received, we can ignore column E9. Columns E6 and E7 deal with PTEP created under the Section 965 transition tax. This tax requires U.S shareholders of existing CFCS as of the end of 2017 to include all of the CFC's earnings and profits in their income. These earnings were taxed at a reduced rate through a sliding scale deduction....

Award-winning PDF software

Video instructions and help with filling out and completing Form 5471 (Schedule J) vs. Form 5471 Schedule O